While many people instinctively understand the asset-protections benefits of irrevocable trusts, most people are afraid of giving away their assets. After all, while you may have a few million dollars that you wish to protect from future lawsuits or other actions, you are going to need that money to live on now or to cover later unforeseen.

By settling your trust in a jurisdiction that allows for self-settled spendthrift trusts, you can be the beneficiary of your own trust and still benefit from what you have worked years to achieve.

For an in-depth background on trusts and how they work, please see our page “What is a trust” (hyperlinked, and website address for the emailed version).

How It Works

In short: In a Trust the settler (you) asks a trustee (the trust company) to hold on to and look after assets for the benefit of a beneficiary. This creates a great amount of protection for the assets. When you settle the trust, the assets are no longer considered to be yours. Therefore they are immune from your creditors.

Traditionally in the United States and other countries self-settled trusts were not allowed. Or, if they were allowed they lost all of the meaningful asset protection as a judge would simply tell the settlor/beneficiary that clearly you have enough control of these assets that you can use them to pay your creditors. (Side note: Some US States do now allow self-settled trusts, however their asset protection is weak at best. See: Why is wrong the domestic asset protection trusts.

Anguilla is one of a few jurisdictions with a long history of self-settled trusts, so you can safely contribute assets to an Anguillan trust while still receiving the benefits thereof.

How To Be The Beneficiary Of Your Own Trust

Example

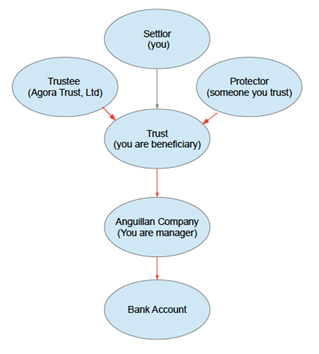

This what an offshore structure might look like:

In this example, the settlor settles a trust.

The trust then forms an Anguillan LLC or International Business Company, and the Trustee appoints the settlor as the manager of the company.

The company then opens a bank or brokerage account.

The settlor is now managing his assets just as before and can even pay himself a salary as needed.

This Trust has the additional benefit of being a vehicle through which you can conduct your estate planning.

A relatively simple structure allows you to completely insulate your assets while leaving you in control of them.

Note: To get the maximum benefit of a self-settled trust, it is helpful if there are other beneficiaries (such as your children).

What To Do Next

The only challenge with a trust is that it is very individual. While the process is the same, your trust is going to have different needs than average Joe down the street.

Take a moment right now to fill out the contact form below to get in touch with our team.